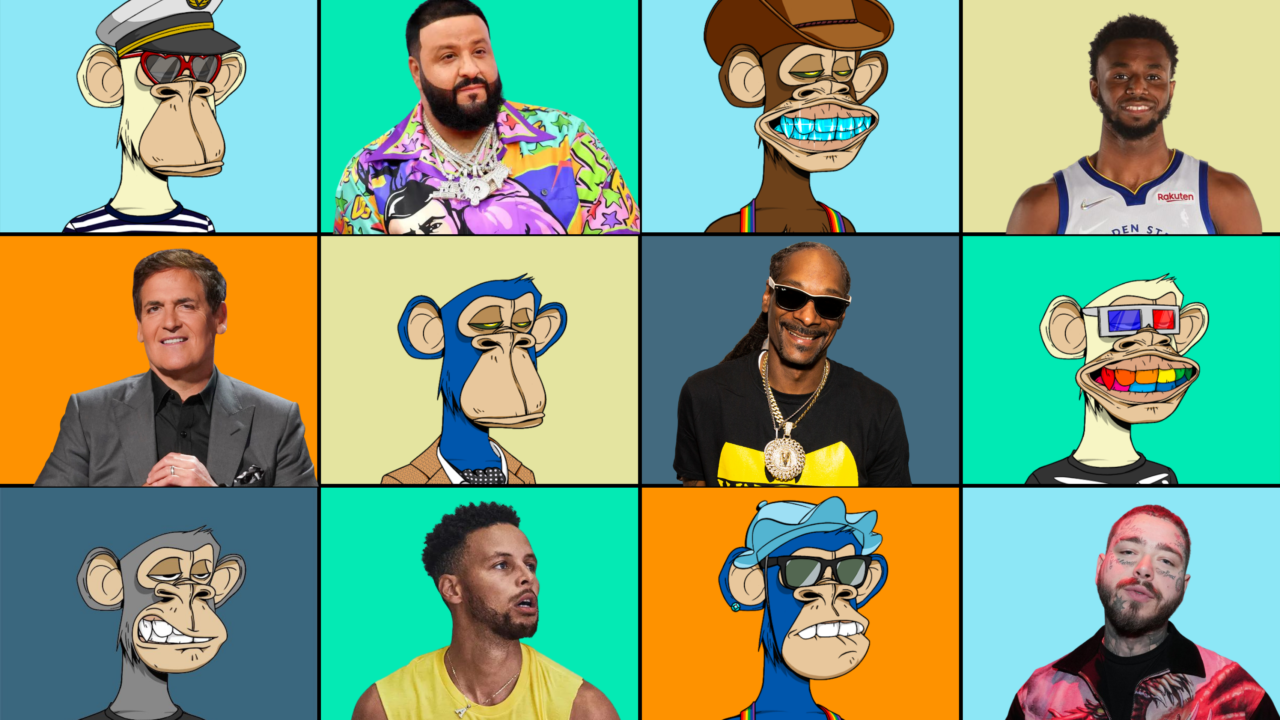

🏆Justin Bieber, Kevin Hart, Stephen Curry, Gwyneth Paltrow, Madonna, and other celebs sued over NFT promotion

The proposed class-action suit claims that MoonPay, a fintech company valued at $3.4 billion, and talent manager Guy Oseary conspired and engaged in fraudulent activity by recruiting prominent celebrities to invest in the company without disclosing their financial interest.

The suit also alleges that celebrities, including Justin Bieber, Kevin Hart, and Gwyneth Paltrow, promoted MoonPay's services without disclosing their stake in the company. The suit claims that the celebrities convinced potential investors to purchase non-fungible tokens (NFTs), which are now worth a fraction of their original value.

Other celebs named in the suit include Justin Bieber, Kevin Hart, Stephen Curry, Serena Williams and her husband, Reddit CEO Alexis Ohanian, Snoop Dogg, The Weeknd, DJ Khaled, and many others.

Jimmy Fallon did a segment on NBC’s “The Tonight Show” in November 2021, telling viewers he got his first Bored Ape Yacht Club NFT through Moonpay — without saying he had a stake in Moonpay, the lawsuit alleges.

The talk show host and NBC didn’t tell the audience that “this purportedly organic segment on the Tonight Show was in reality a paid advertisement for the BAYC collection of NFTs and MoonPay,” the complaint states.

“The Company’s entire business model relies on using insidious marketing and promotional activities from A-list celebrities that are highly compensated (without disclosing such), to increase demand of the Yuga securities,” according to the complaint filed in US District Court for the Central District of California.

The proposed class-action suit says the famous NFT backers committed fraud “by convincing potential retail investors that the price of these digital assets would appreciate.” Now, some of those investments are worth about 2% - 10% of their original value.

The suit also says Bieber fraudulently claimed he purchased an NFT for $1.3 million, when it was actually gifted to him in exchange for promotion.

Yuga Labs, for its role, industriously denies the allegations. Receiving secret payouts through an elaborate cover-up operation would almost certainly fulfill that standard; however, whether such a scheme can be proven is another matter. The U.S. Securities and Exchange Commission (SEC) is investigating Yuga Labs over potential securities violations.