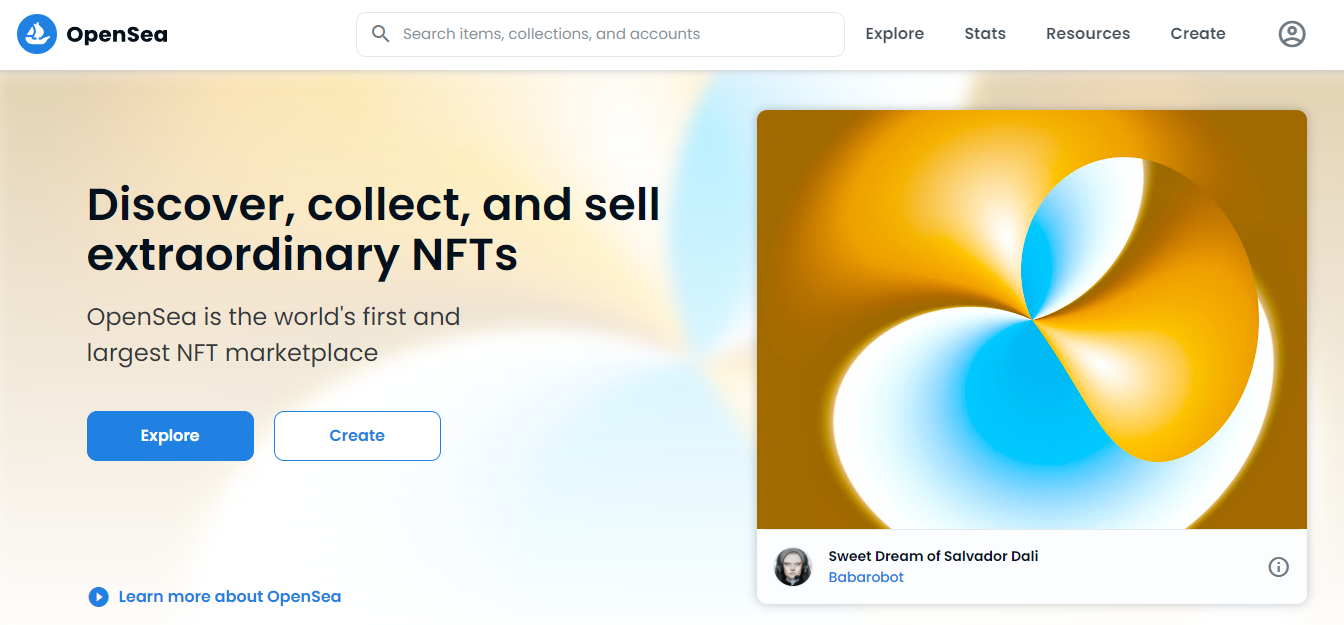

🚀 OpenSea Hits Record $5B in Monthly Trading as Ethereum NFT Market Swells

Leading NFT marketplace OpenSea generated more than $5 billion in total trading volume in January between Ethereum and Polygon sales, breaking the previous record from August 2021.

OpenSea had more than $4.95 billion of Ethereum trading volume in January and surpassed the previous Ethereum peak in August 2021 as the NFT market exploded following a subdued summer, topping $3.4 billion in trading volume for the month.

OpenSea reported its best single day in months, January 31, with $233 million worth of NFT trading. It’s one of four single days above the $200 million mark for Ethereum trading in January for the marketplace.

OpenSea blew past its previous Ethereum record as the NFT market soars to even greater heights. Early in January, OpenSea also revealed a $300 million Series C round that valued the company at $13.3 billion.

It wasn’t all smooth sailing for OpenSea in January, however. Some OpenSea users saw their high-value NFT collectibles sold for a fraction of their estimated worth due to a UI exploit, and the firm has thus far paid out $1.8 million worth of ETH to affected customers.

Also last month, OpenSea announced plans to limit the number of NFTs that can be minted with its own smart contract (i.e., computer code), effectively stopping some active projects in their tracks. The news was met with near-universal backlash and OpenSea reversed course, announcing that it would instead pursue other ways to limit the creation of plagiarized and spam NFTs on the platform.

OpenSea is a prominent indicator of the NFT market’s momentum, which has continued surging despite a rough month for cryptocurrency prices. Some traders may see valuable, blue-chip NFT projects like the Bored Ape Yacht Club and Doodles as a store of value as the crypto market falls. Others may be taking advantage of the dip to buy into NFTs in a big way.

An NFT works like a blockchain-verified deed of ownership to a digital item, whether it’s an image, video file, video game item, or something else. The market rose to an estimated $23 billion in total trading volume over the course of 2021, per data from DappRadar.

That momentum has carried into 2022 thus far, and OpenSea is not the only platform that saw significant trading action in January. New Ethereum marketplace LooksRare is a prime example, but it’s one that comes with caveats.

Launched on January 10, the marketplace is built around its own LOOKS token that was airdropped free to select OpenSea users to draw them to the platform. LOOKS tokens are also paid out daily to NFT traders that use LooksRare.

However, some traders have manipulated the system by selling NFTs for highly exaggerated prices back and forth between their own controlled wallets—a form of wash trading. Collections like Meebits and Terraforms, which trade without royalties due to the creators, have generated billions of artificially inflated trading volume via LooksRare in recent weeks.

As of Friday, January 28, crypto analytics firm CryptoSlam said that it had identified more than $8.3 billion worth of wash trading on LooksRare. With Dune Analytics reporting $9.5 billion in total trading volume at the time, that would suggest that about 87% of trading on the site was attributed to manipulated sales as of that date.

Still, that leaves potentially more than $1 billion worth of legitimate trading volume—plus activity from the weekend and Monday—on a brand new NFT marketplace in January. And that comes on top of OpenSea’s own growing Ethereum activity.

Over on the Solana blockchain, top marketplace Magic Eden appears to have had a sizable month, as well. DappRadar’s figures suggest more than $531 million worth of trading volume over the past 30 days, as of this writing—a nearly 89% uptick over the previous 30-day span.

The Bored Ape Yacht Club profile picture project—which pulled in celebrities like Justin Bieber and Neymar Jr. in recent weeks—was arguably the biggest winner among NFT collections in January.

According to CryptoSlam, the main collection generated $311 million worth of secondary trading volume last month, a nearly 101% increase over December. Add in secondary sales of the Mutant Ape Yacht Club and Bored Ape Kennel Club collections, and the combined total tops $600 million. Collectively, the three projects have passed the $2 billion total to date.

World of Women project rose more than 1,100% to over $69.5 million last month. Earlier in January, World of Women signed veteran music mogul Guy Oseary to represent it with entertainment and licensing initiatives.

Dapper Labs had a big month in January, as well, with its NBA Top Shot project—which runs on the Flow blockchain—notching its best month of secondary trading volume since last April with over $59 million. That’s a 52% increase from December, plus Top Shot logged its most NFT transactions in a single month with more than 1.8 million in total.

Not every notable NFT project soared in January, however. CryptoPunks notched its lowest month of trading volume since last June, with $124.2 million—a nearly 28% drop from December. CryptoPunks has been seen as losing ground to the Bored Ape Yacht Club, which provides added perks to holders and has seen prominent holders join of late.