🔮Which NFT Trades Are the Most Profitable? Data knows.. 👩🚀To Mint or Not to Mint That is the Question!

NFT collectors do the best when they are really early or HODL longer! According to the latest Chainalysis report here are few figures and takeaways!

So far in 2021, users have sent at least $26.9 billion worth of cryptocurrency to ERC-721 and ERC-1155 contracts, the two types of Ethereum smart contracts associated with NFT marketplaces and collections.

Notably, we see significant increases in both total value sent and average transaction size, suggesting that NFTs as an asset category are gaining value as they attract new users.

There’s also a noticeable spike beginning in the last week of August, which appears to have been largely driven by the release of a new collection from the popular NFT creator group Bored Ape Yacht Club.

OpenSea is the most popular marketplace by a wide margin, with over $16 billion worth of cryptocurrency received so far in 2021

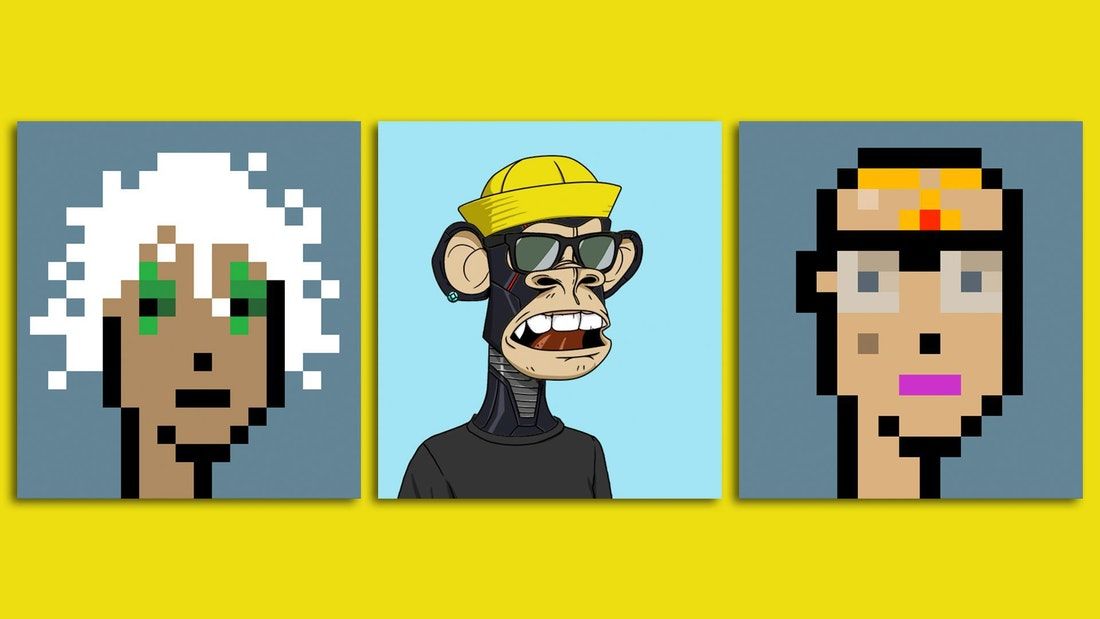

CryptoPunks, which was established in 2017 well before the current NFT craze, has been the most popular NFT collection during the time period studied, with more than $3 billion in transaction volume since March 2021.

As the most popular NFT marketplace, analysis of OpenSea can tell us a great deal about NFT growth overall. Over 6,000 NFT collections on OpenSea have undergone at least one transaction, including buying, selling, or minting.

The number of active NFT collections peaked at over 2,300 the week of October 24, 2021, up from just 193 at the beginning of March.

When it comes to individual sales Beeple led the pack with the $69 million sale of his “Everydays” digital art NFT collection in March. The Board Ape Yacht Club collection doubled trading volume on OpenSea when its sales spiked 900% this month. And Visa paid $165,000 for an NFT from the CryptoPunk collection in August, which has since seen its basement price soar to 67 ETH, or $286,000.

While most are here for the Art and the Freedom, the few that are here for the profits are not always lucky! The data suggests that NFTs are far from a surefire investment, however. Transaction data from the OpenSea marketplace shows that just 28.5% of NFTs purchased during minting and then sold on the platform result in a profit. Buying NFTs on the secondary market from other users and flipping them, however, leads to profit 65.1% of the time.

Whitelisting is key to success in trading newly-minted NFTs

More than anything else, NFTs run on community and word of mouth growth. Look at virtually any successful NFT project, and you’ll likely find Discord servers and Twitter threads full of enthusiasts promoting the project. This is by design. NFT creators typically begin building interest in new projects long before the first assets are released, gathering a core of dedicated followers who help promote the project from the outset. NFT creators will then reward those dedicated followers by adding them to a “whitelist,” allowing them to purchase new NFTs at a much lower price than other users during minting events.

Overall, 78% of sales by unwhitelisted buyers later result in a loss on resale, with 59% resulting in a loss equal to or below 0.5x their initial investment. 78% of sales by whitelisted buyers, on the other hand, result in a profit, with 51% resulting in a profit of 2x or more the initial investment

If you can’t find your way onto a whitelist, you may want to think twice before minting an NFT!

With Coinbase entering the NFT race with it’s a marketplace and over 2.5 Million of their 68 Million customers on the Waitlist List. Coinbase’s initial launch is just for the USA, where they can work out some of the challenges and work on user experience.

🕎Happy Hanukkah 🎅Merry Christmas ☃️Healthy and Prosperous New Year!